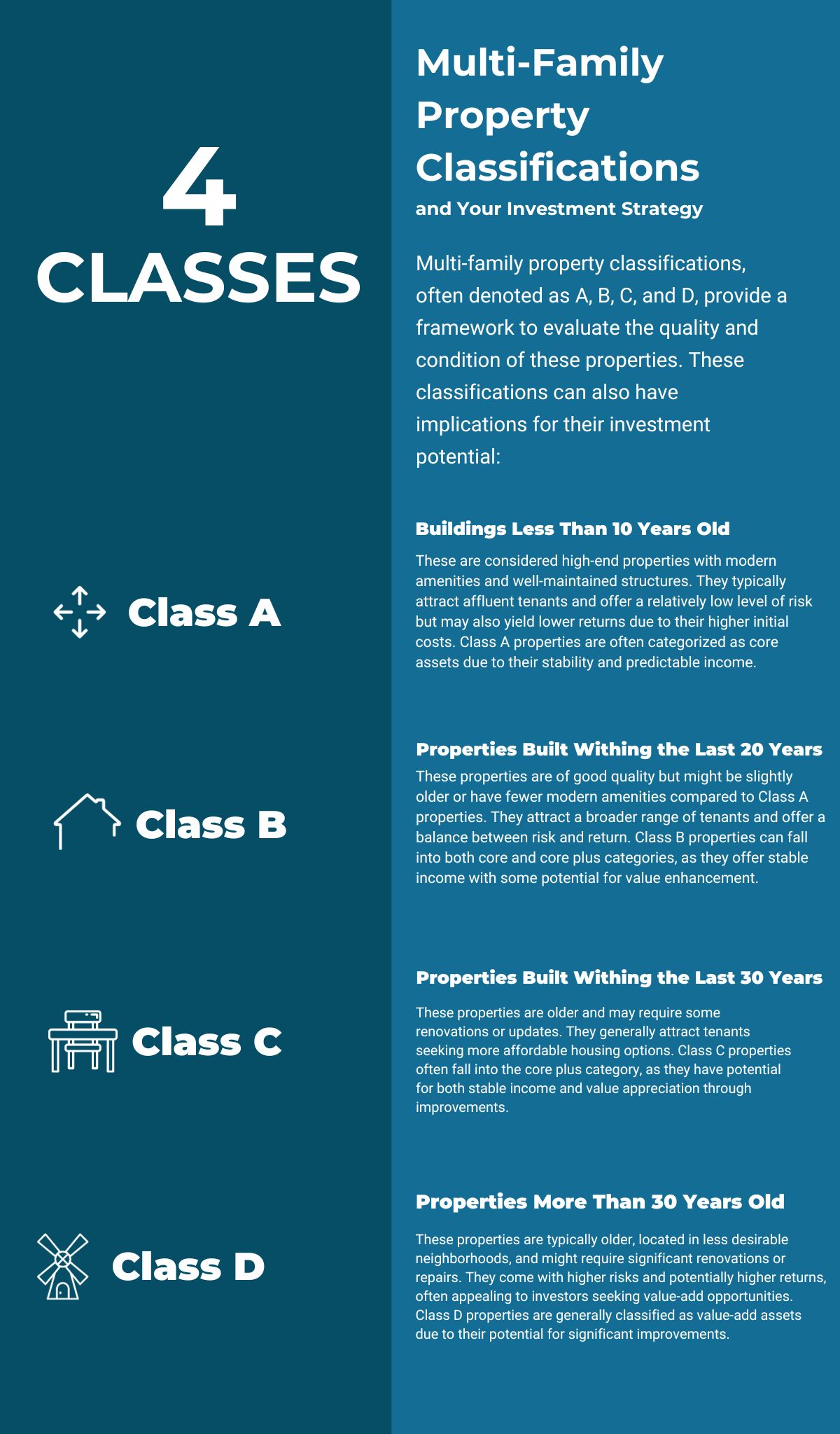

Dive into the meanings behind multi-family property classifications: A, B, C, and D. Which ones qualify as core assets? Which can be dubbed as core-plus assets? And, crucially, depending on whether you aim for a conservative or aggressive investment strategy, where should your gaze rest? This article has your answers.

Classification – Class A

Class A properties, typically younger than 10 years or extensively renovated if older, are the epitome of luxury. Their fixtures and amenities are top-notch, but they often come with a lower yield percentage. Despite this, their potential for growth is remarkable, and they maintain value even in economic lows. Regarded as core assets, these properties are favored by REITs and institutional investors for their steady income stream. However, deviations, like a less prime location, could place them in the “core plus” risk bracket.

Classification – Class B

Moving to Class B, these properties are within the 20-year mark. While their construction is commendable, they might show signs of deferred maintenance. Their fixtures and amenities might not be as stellar as Class A, but they hold their own.

Classification – Class C

Class C properties, constructed within the last 30 years, definitely have noticeable maintenance lapses. Their location may not be as favorable, and management may have been subpar. Their dated and lower-quality finishings and minimal amenities set them apart. Both Class B and Class C properties have potential for a ‘value add’ strategy. Enhancements, from tackling maintenance to renovating, can uplift their value, but this comes with risks tied to higher leverage as Ian Ippolito elucidates.

Classification – Class D

Lastly, Class D properties are those more than 30 years old and show clear signs of wear, tear, and sometimes neglect. They might be situated in less desirable areas and showcase extensive use. Yet, their high renovation requirements make them apt for an ‘opportunistic’ strategy, posing higher risks but also promising potentially greater returns.

Summary

The US multi-family real estate landscape remains a promising arena for discerning investors. This article demystified the varied multi-family property classifications and highlighted their respective investment profiles. Should you seek more guidance, our expert team is here to assist.